Aluminium Scrap

(2170 products)Aluminum Bronze Metal Scrap

Product DescriptionBacked by a rich industrial experience, we are engaged in supplying, exporting and distributing a huge range of Aluminum Bronze Scrap to our customers in Ahmedabad, Gujarat, India. These are offered by keeping vigil eye on the demands. Along with this, these scraps are available in the market at ver

Aluminium Extrusion Scrap - Recycled Raw Material, High Purity and Quality Assurance

Product DescriptionBacked by a rich industrial experience, we are engaged in manufacturing and supplying a huge range of Aluminium Extrusion Scrap in Silvassa, Dadra and Nagar Haveli, India. These are offered by keeping vigil eye on the demands. Along with this, these scraps are available in the market at very reasona

Aluminium Wire Scrap - Color: Different

Price: 210 INR/Kilograms

MOQ10 Ton/Tons

ConditionUsed

SizeAs Per Requirment

ThicknessDifferent Available Millimeter (mm)

ColorDifferent

Aluminium Cable Scrap - Different Sizes and Thicknesses, Silver Color, Old Condition, Customizable Weight

MOQ10 Ton/Tons

SizeDifferent available

ConditionOld

Scrap TypeCable Scrap, Other

ThicknessDifferent available Millimeter (mm)

ColorSilver

WeightAs per requirement Kilograms (kg)

Siam Export Limited Partnership

Bangkok

Premium Seller

Premium Seller5 Years

Aluminium Scraps

Price Trend: 1400-1500 USD ($)/Tonne

MOQ1 FCL Ton/Tons

ConditionScrap

Scrap TypeAluminium Tense

Uniexcel Group

Kolkata

Trusted Seller

Trusted Seller2 Years

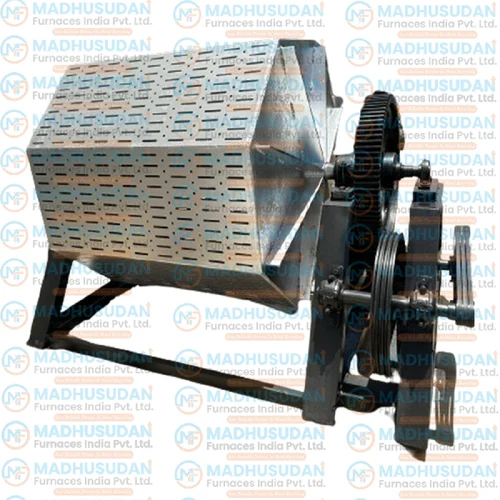

Fully Automatic Aluminium Dross Pulverizer Machine, Material: Mild Steel

Product DescriptionFully Automatic Aluminium Dross Pulverizer Machine

S.r Fab & Engineering Works

New Delhi

Trusted Seller

Trusted Seller1 Years

Aluminium Wire Scrap - Color: As Per Availability

MOQ100 Kilograms/Kilograms

AlloyYes

SizeVarious Sizes Available

ConditionUsed / Normal

Scrap TypeOther, Aluminum

ColorAs Per Availability

Hariom Metals Private Limited

Jamnagar

Trusted Seller

Trusted Seller2 Years

Ubc Aluminum Scraps

Product DescriptionOur organization has garnered a remarkable position in this industry by Exporter, Supplier, Trading Company of A Grade Quality UBC Aluminum Scraps in Mersin, Icel, Turkey. This product is sourced from the most eminent and trusted sources in the market. Moreover, we offer this product to our customer

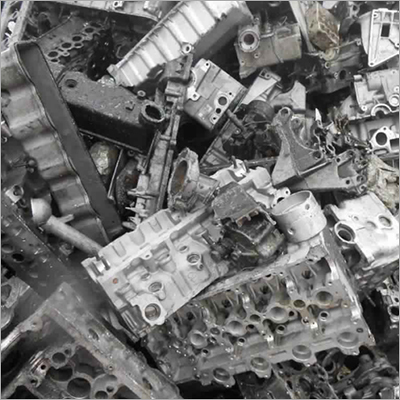

Aluminium Casting Scrap

Price Trend: 11000.00 - 33000.00 INR/Ton

MOQ2 Ton/Tons

ConditionUsed

Sha Mithalal Tejmal Jain

Pune

Trusted Seller

Trusted Seller6 Years

Industrial Ubc Aluminum Extrusion Scrap

Price: 300 USD ($)/Metric Ton

MOQ25 Metric Ton

ConditionScraps

Scrap TypeOther, Aluminum Extrusion Scrap

ColorSilver

Super Fortune International Co., Ltd

Kowloon

Aluminium Ash - Recyclable Smelting Byproduct with Varying Adsorbent Mass, pH Levels, and Initial Dye Concentration | Efficient Textile Wastewater Adsorption Solution

Payment TermsPaypal, Others, Western Union, Telegraphic Transfer (T/T)

Sample AvailableYes

Sample PolicyContact us for information regarding our sample policy

Pt. Sinar Laut Biru Logam Perkasa Jaya

Jakarta

Industrial Aluminium Scrap - Customizable Weight, Varied Sizes & Thicknesses - Sleek Silver Finish, Sustainable Solution for Manufacturing

MOQ10 Ton/Tons

SizeDifferent available

ConditionOld

ThicknessDifferent available Millimeter (mm)

ColorSilver

WeightAs per requirement Kilograms (kg)

Used Aluminium Cans Scraps - Color: Multicolor

MOQ1 Ton/Tons

SizeVarious Sizes Available

AlloyYes

ConditionUsed / Normal

Scrap TypeAluminium Can

ColorMulticolor

Industrial Aluminium Scrap

Price: 750 USD ($)/Ton

MOQ5000 Ton/Tons

Product DescriptionIndustrial Aluminium Scrap

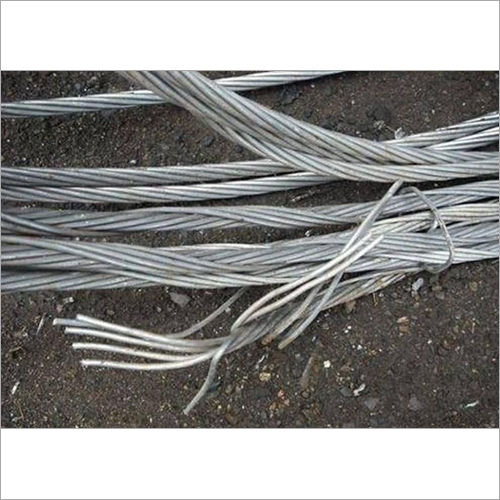

Silver Aluminium Conductors Scrap

Price: 140 INR/Kilograms

MOQ1 Ton/Tons

SizeDifferent Available

ConditionOld

ThicknessDifferent Available Millimeter (mm)

ColorSilver

WeightAs per requirement Kilograms (kg)

Shree Shiv Shankar Trading Co.

Howrah

Aluminium Scraps - ISRI Grades 'Taint', 'Tabor', 'Tense', 'Talon', 'Telic' | Versatile Industrial Applications, Various Sizes and Shapes

Product DescriptionAll Grades Of Al Scraps As Per 'Isri' Like 'Taint' / 'Tabor', 'Tense', 'Talon', 'Telic', Etc. Our range of Aluminium Scraps can be availed in different specifications such as sizes, shapes etc. These Aluminium Scraps are applicable in various industrial usage

Aluminum Profile Scrap Size: Various

Price: 500 USD ($)/Ton

MOQ1000 Ton/Tons

ConditionScrap

SizeVarious

ColorAluminum

Scrap TypeAluminum SCRAP

ThicknessAluminum SCRAP Meter

H To H Investment

Gauteng

Trusted Seller

Trusted Seller8 Years

Aluminum Sheet - Various Sizes 50mm-8000mm, Silver Color, Thickness 0.12mm-260mm, Coated and Embossed Finishes for Versatile Applications

MOQ50 Metric Ton

SizeVarious sizes are available

Scrap TypeAluminium Sheet

Width50-250 Millimeter (mm)

ColorSilver

Joll Llc

Florida City

Trusted Seller

Trusted Seller4 Years

Silver Litho Sheet Scrap

Price: 220 INR/Kilograms

MOQ1000 Kilograms/Kilograms

ConditionScrap

SizeVarious Available

Scrap TypeAluminium Sheet

Thickness.3 mm Millimeter (mm)

ColorSilver

Adhar Agro Equipments

Jaipur

Trusted Seller

Trusted Seller2 Years

Aluminium Purja Scrap

Price: 160 INR/Kilograms

MOQ3 Ton/Tons

ConditionNormal

Scrap TypeOther, Aluminium

Aluminium Ubc Scrap - Color: All

Price: 1100 USD ($)/Ton

MOQ10 Ton/Tons

AlloyYes

SizeMulitple

ConditionUsed

Scrap TypeAluminium Can

ColorAll

Industrial Aluminium Scrap - Customized Weight, Old Condition, Silver and Black Colors | Pure Aluminium, Various Sizes and Thicknesses, Premium Quality

Price: 145 INR/Kilograms

MOQ10000 Kilograms/Kilograms

ConditionOld

SizeDifferent available

Scrap TypeOther, Aluminium

ThicknessDifferent available Millimeter (mm)

ColorSilver, Black

WeightAs per requirement Kilograms (kg)

Multi Color Ubc Aluminium Used Beverage Cans Scrap

Price: 60 USD ($)/Metric Ton

MOQ1000 Metric Ton/Metric Tons

ConditionUsed

Scrap TypeAluminium Can

ColorMulti Color

Industrial Aluminum Scrap - Color: Silver

MOQ1000 Kilograms/Kilograms

SizeDifferent Size

ConditionNew

AlloyAluminium

Scrap TypeAluminium Sheet

ColorSilver

Aluminium Tt Scrap - Size: Different Available

Price: 162 INR/Kilograms

MOQ100 Kilograms/Kilograms

AlloyNo

ConditionNormal

SizeDifferent Available

Scrap TypeAluminium Sheet

Latest From Aluminium Scrap

Ready To Ship Aluminium Scrap

Indian Aluminium Scrap Market Dynamics

From 2020 to 2025, the Indian market for aluminum scrap recycling is forecast to expand by 8.16% at a compound annual growth rate (CAGR) of 11782.76 metric tons.

According to the media, the main producers have reportedly lobbied the government to increase the tax to 12%, giving the reason that they are losing revenue as a result. Seventy percent of recycled aluminum is used in automobiles, with the rest going to other industries including construction, packaging, and home appliances.

- Alcoa Corp.,

- Hindalco Industries Ltd.,

- Kuusakoski Group Oy,

- Constellium SE,

- Matalco Inc.,

- Norton Aluminium Ltd.

- Rio Tinto Ltd.

- Metal Exchange Corp.,

- Real Alloy

Trends:

One key barrier that has been slowing the expansion of the aluminum scrap recycling sector is the declining recycling rate of empty beverage cans. The diminishing stock market for beverage cans is a problem for the aluminum cans industry, notably in North America.

What is an Aluminium scrap?

In the process of creating aluminum semi-finished and finished goods, new scrap is generated. The term "old scrap" is used to describe materials salvaged from consumer trash. Many times, used materials are more polluted than brand new ones. Aluminum may be salvaged from a wide variety of sources, including woworn-altars, destroyed buildings and structures, unwanted packaging materials, outdated electronics, and worn-out machinery.

Its significance

Aluminum, like other nonferrous metals, can be recycled indefinitely without loss of quality, and recycled aluminum is prized as a key raw material input for the manufacture of new aluminum. In 2012, the United States recovered more than 3.4 million metric tons of aluminum metal from newly produced and recycled scrap.

Used aluminum beverage containers, metal cladding, old radiators, old wire and cable, automobile and truck wheels, and scrap cars and aircraft are just some of the many items that may be recycled to produce new aluminum goods. In 2012, the aluminum scrap collected by ISRI was equivalent to 54% of the total apparent aluminum use in the United States. More than 2 million metric tons of aluminum scrap left the United States last year for export.

According to USGS estimates, over 53% of the 3.4 million tons of aluminum salvaged from bought scrap in the United States at the end of the year originated from fresh (manufacturing) waste, while 47% came from old scrap (discarded aluminum products).

About 35% of the apparent use of aluminum in the United States was reclaimed from scraps, such as bottles and cans, and other outmoded items.

Secondary smelters, which use aluminum scrap to create new aluminum and aluminum alloy shapes like ingots, sows, and other products, were the biggest consumers of domestically acquired aluminum scrap last year, recovering over 1.9 million metric tons of aluminum alloys by metallic content, according to government statistics.

Independent mill fabricators (1.4 million metric tons), manufacturing facilities (97,000 metric tons), and other customers accounted for the next three major users of aluminum scrap in 2012. (7,000 metric tons).

A market-seeking equilibrium was exemplified by the light metal at the beginning of 2014. The world's aluminum output has increased despite the over 5,4 million metric tons of metal that have been stockpiled in LME warehouses.

The International Aluminum Institute estimates that in 2013, both reported and unreported aluminum output in China topped 24 million, marking a 10% rise over the previous year.

Aluminum Scrap Recycling Market in India- Forecast, and Analysis

The primary factors that are predicted to boost the growth of the Indian industry are the increased usage of aluminum in the car sector in India and the rise in acceptance of aluminum recycling procedures in India. Aluminum scraps for recycling firms often come from construction demolition.

The research also predicts that urbanization and industrialization in emerging nations would drive demand for steel, which will, in turn, drive market growth during the projected period.

The growing aluminum recycling business is being driven by rising environmental concerns about the rapid depletion of natural resources.

North America, Latin America, Europe, the Middle East & Africa, and Asia-Pacific are all subsegments of the Indian aluminum scrap recycling market. Aluminum scrap recycling is most popular in Asia and the Pacific. The fastest-growing consumer markets in the area are China and India, with the latter also playing a significant role in the expansion of the Indian market.

The expansion of the construction and building industry and the rising demand for consumer durables both contribute to the region's booming market.

The Aluminum Scrap Recycling Capacity, Productivity, Annual Growth, and Customer Base by Companies and by Region (Region department and Country level) from 2017 to 2022 and Forecast to 2028 is the focus of this study.

This study analyzes the sales of aluminum scrap recycling from 2017 to 2028 by region (region level and national level), business, Type, and Use.

FAQs: Aluminium Scrap

- Aluminum Cans

- Cast aluminum

- Dirty Aluminium

- Aluminum gutter or sliding

- Aluminum wire

- Sheet Aluminium

- Aluminum Rims

Manufacturers & Suppliers of Aluminium Scrap

Company Name | Member Since |

|---|---|

Metalic Corporation India Kolkata, India | 21 Years |

Govind Metal Co. Ahmedabad, India | 16 Years |

Pankaj Industries (I) Mumbai, India | 16 Years |

Abbay Trading Group, Co Ltd Mersin, Turkey | 10 Years |

Pt. Sinar Laut Biru Logam Perkasa Jaya Jakarta, Indonesia | 8 Years |

H To H Investment Gauteng, South Africa | 8 Years |

Baheti Metal And Ferro Alloys Ltd Ahmedabad, India | 6 Years |

Sha Mithalal Tejmal Jain Pune, India | 6 Years |

Maluna Pharm Moscow, Russia | 6 Years |

Sustisak Enterprise Ltd Phuket, Thailand | 6 Years |

Popular Products